Advertisement

-

Published Date

March 25, 2022This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

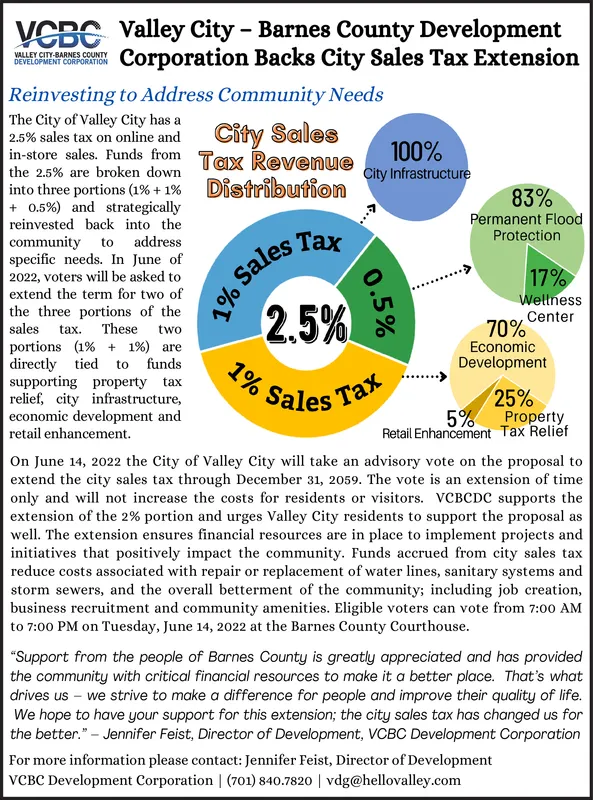

VCBC Valley City - Barnes County Development Corporation Backs City Sales Tax Extension VALLEY CITY-BARNES COUNTY DEVELOPMENT CORPORATION Reinvesting to Address Community Needs The City of Valley City has a 2.5% sales tax on online and City Sales in-store sales. Funds from Tax Revenue 100% the 2.5% are broken down City Infrastructure into three portions (1% + 1% Distribution + 0.5%) and strategically reinvested back into the 83% Permanent Flood Protection Tax community to address specific needs. In June of 2022, voters will be asked to extend the term for two of 17% Wellness the three portions of the sales 2.5% Center 70% tax. These two portions (1% + 1%) are directly tied to funds supporting property tax relief, city infrastructure, economic development and retail enhancement. Economic Development 1% Sales Tax 25% 5% Property Retail Enhancement Tax Reliéf On June 14, 2022 the City of Valley City will take an advisory vote on the proposal to extend the city sales tax through December 31, 2059. The vote is an extension of time only and will not increase the costs for residents or visitors. VCBCDC supports the extension of the 2% portion and urges Valley City residents to support the proposal as well. The extension ensures financial resources are in place to implement projects and initiatives that positively impact the community. Funds accrued from city sales tax reduce costs associated with repair or replacement of water lines, sanitary systems and storm sewers, and the overall betterment of the community; including job creation, business recruitment and community amenities. Eligible voters can vote from 7:00 AM to 7:00 PM on Tuesday, June 14, 2022 at the Barnes County Courthouse. "Support from the people of Barnes County is greatly appreciated and has provided the community with critical financial resources to make it a better place. That's what drives us we strive to make a difference for people and improve their quality of life. We hope to have your support for this extension; the city sales tax has changed us for the better."- Jennifer Feist, Director of Development, VCBC Development Corporation For more information please contact: Jennifer Feist, Director of Development VCBC Development Corporation | (701) 840.7820 | vdg@hellovalley.com E... 0.5% 1% Sales VCBC Valley City - Barnes County Development Corporation Backs City Sales Tax Extension VALLEY CITY-BARNES COUNTY DEVELOPMENT CORPORATION Reinvesting to Address Community Needs The City of Valley City has a 2.5% sales tax on online and City Sales in-store sales. Funds from Tax Revenue 100% the 2.5% are broken down City Infrastructure into three portions (1% + 1% Distribution + 0.5%) and strategically reinvested back into the 83% Permanent Flood Protection Tax community to address specific needs. In June of 2022, voters will be asked to extend the term for two of 17% Wellness the three portions of the sales 2.5% Center 70% tax. These two portions (1% + 1%) are directly tied to funds supporting property tax relief, city infrastructure, economic development and retail enhancement. Economic Development 1% Sales Tax 25% 5% Property Retail Enhancement Tax Reliéf On June 14, 2022 the City of Valley City will take an advisory vote on the proposal to extend the city sales tax through December 31, 2059. The vote is an extension of time only and will not increase the costs for residents or visitors. VCBCDC supports the extension of the 2% portion and urges Valley City residents to support the proposal as well. The extension ensures financial resources are in place to implement projects and initiatives that positively impact the community. Funds accrued from city sales tax reduce costs associated with repair or replacement of water lines, sanitary systems and storm sewers, and the overall betterment of the community; including job creation, business recruitment and community amenities. Eligible voters can vote from 7:00 AM to 7:00 PM on Tuesday, June 14, 2022 at the Barnes County Courthouse. "Support from the people of Barnes County is greatly appreciated and has provided the community with critical financial resources to make it a better place. That's what drives us we strive to make a difference for people and improve their quality of life. We hope to have your support for this extension; the city sales tax has changed us for the better."- Jennifer Feist, Director of Development, VCBC Development Corporation For more information please contact: Jennifer Feist, Director of Development VCBC Development Corporation | (701) 840.7820 | vdg@hellovalley.com E... 0.5% 1% Sales